FAST SECURE RELIABLE.

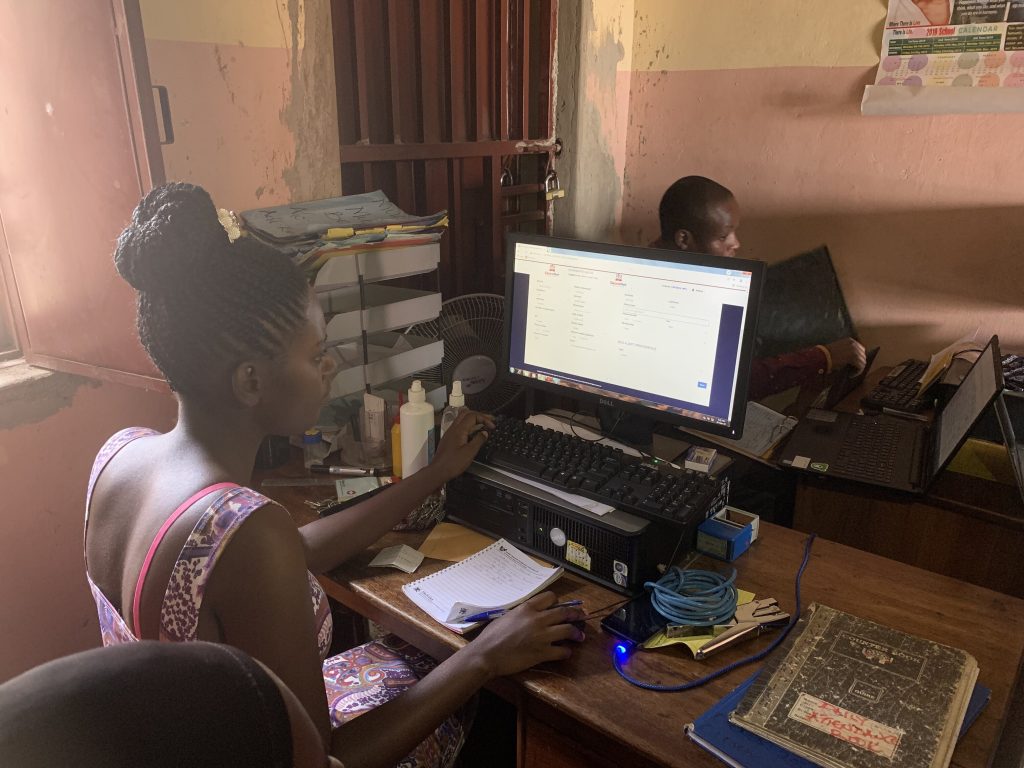

Sacconet is core banking system aimed at automating operations of small and medium microfinance institutions from paper-based to online.

THANKYOU FOR CHOOSING SACCONET !

SACCONET is a cloud-based Banking “Software-As-A-Service” (SAAS) solution that provides a convenient, reliable and cheapest way to grow savings, access credit and make payments for Microfinance institutions, village banks or savings and credit cooperatives of any size. This cloudbased storage, transactions management and tracking software provides standard accounting and reporting functionality for extraordinary organizational efficiency, improved risk management and additional income generation to the cooperative institution.

FAST

SACCONET has been designed with the latest core technologies making it very fast at loading hence boosting transaction processes

SECURE

SACCONET provides high assurance self-encrypting data storage solutions.We guarantee that users data will be safe

RELIABLE

Our tech support team is always available in case your microfinance institution gets challenges in using SACCONET.

AUTOMATE YOUR SACCO TODAY.

Get in touch with us today to have your sacco fully automated.

SACCONET

FUNCTIONALITY

MODULES

CONFIGURATIONS MODULE

In this module, options and features that can be used to adapt SACCONET application to the requirements of any organization (microfinance organization) can be found. This module is used for System Configuration,System Administration and Users Management.

CUSTOMERS MODULE

SHARES MODULE

SAVINGS MODULE

CHART OF ACCOUNTS

LOANS MODULE

MOBILE BANKING TRANSACTIONS MODULE

The Mobile Banking Transactions module will be used

to efficiently manage both mobile banking and Mobile

Money transactions in SACCONET. These transactions

can be accomplished under the following menus:

Mobile Money Settings, Top-up Float, Mobile Money

Withdrawal, Mobile Money Deposit, Airtime Top-up,

Mobile Money Commission, Mbanking Commission,

SMS Reports, Mbanking Reports,Mobile Money Reports.

GL TRANSACTIONS MODULE

BOOK KEEPING MODULE

ISO 9001:2015 Certified

Sakkonet Technologies Limited is ISO 9001:2015 certified, demonstrating our dedication to quality management and operational excellence. This milestone reinforces our mission to provide dependable, innovative, and customer-focused solutions that empower SACCOs and financial institutions to thrive.

What our clients say

Sacconet is trusted by a wide number of financial institutions in the country

timely reports.

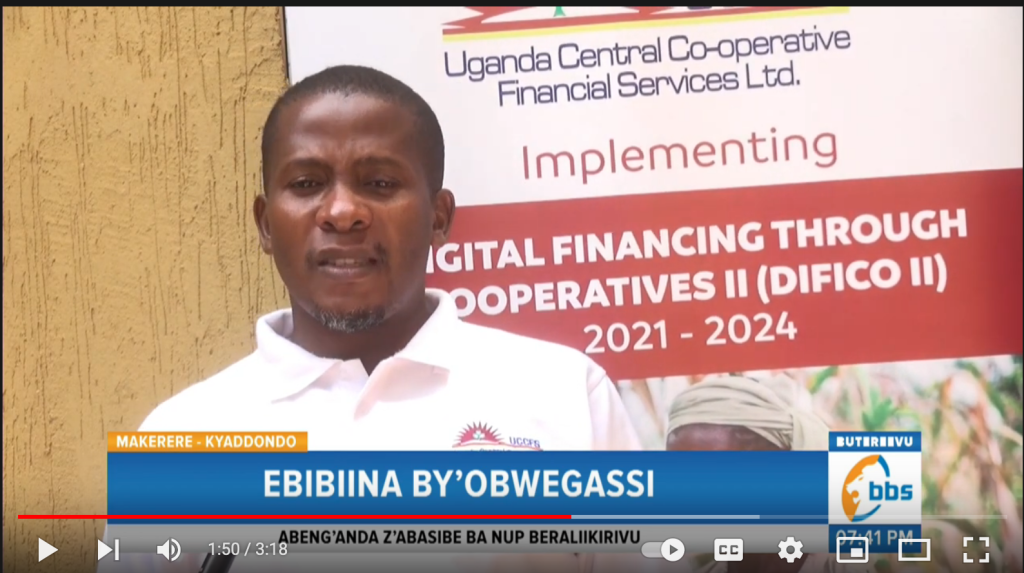

“Enhancing Digital Financing Through Cooperatives !”

Connect with us

Get in touch with us to know more about our financial solutions

Address

UCA Building, Plot 47/49, Nkrumah Road

Phone

Tel: +256 786 235 838 / +256 704 109 418

Email Address

support@sacconet.co.ug / info@sacconet.co.ug

Business Hours

Monday/Friday: 8am to 6pm