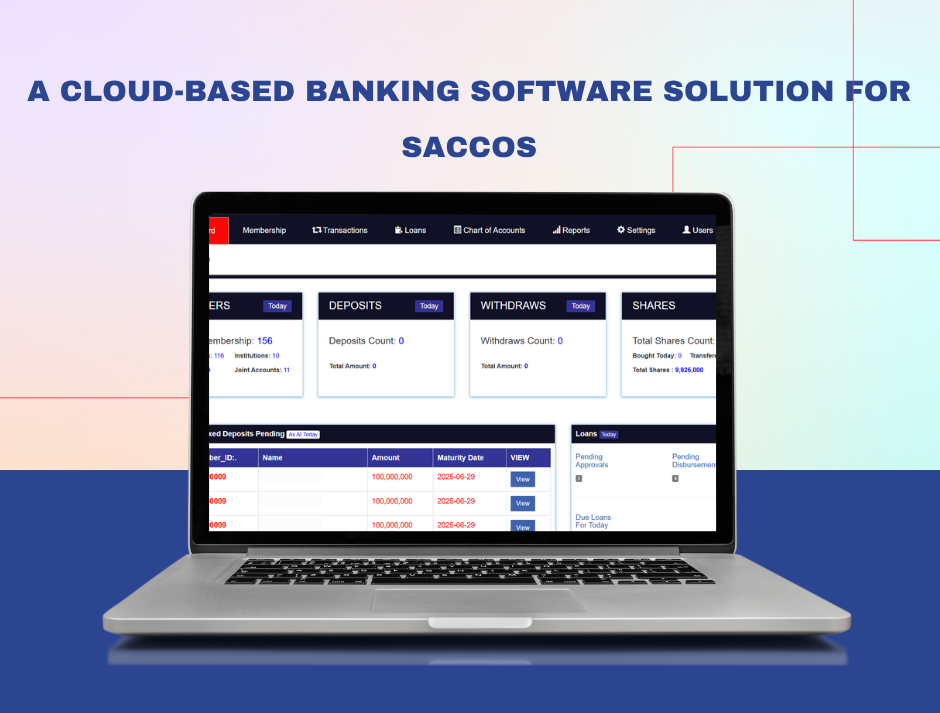

Automate your SACCO

With SACCONET

SACCONET is Uganda’s trusted cloud-based core banking solution, designed by a cooperator (UCCFS) for cooperators. It automates savings, loans, shares, reporting, and compliance processes, enabling SACCOs to cut costs and serve members anytime, anywhere.