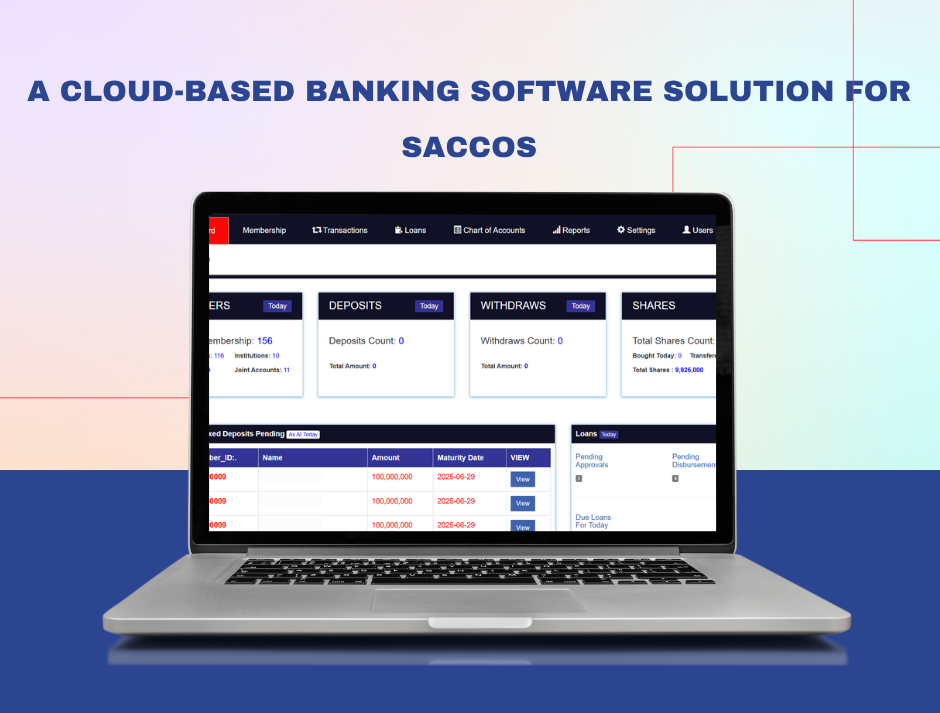

About SaccoNet

Sacconet is a secure, cloud-based SaaS platform designed specifically for Savings and Credit Cooperative Organizations (SACCOs).

It empowers financial institutions to manage savings, loans, shares, and member services seamlessly, while ensuring transparency and efficiency. With Sacconet, SACCOs can digitize operations, improve service delivery, and scale financial inclusion.

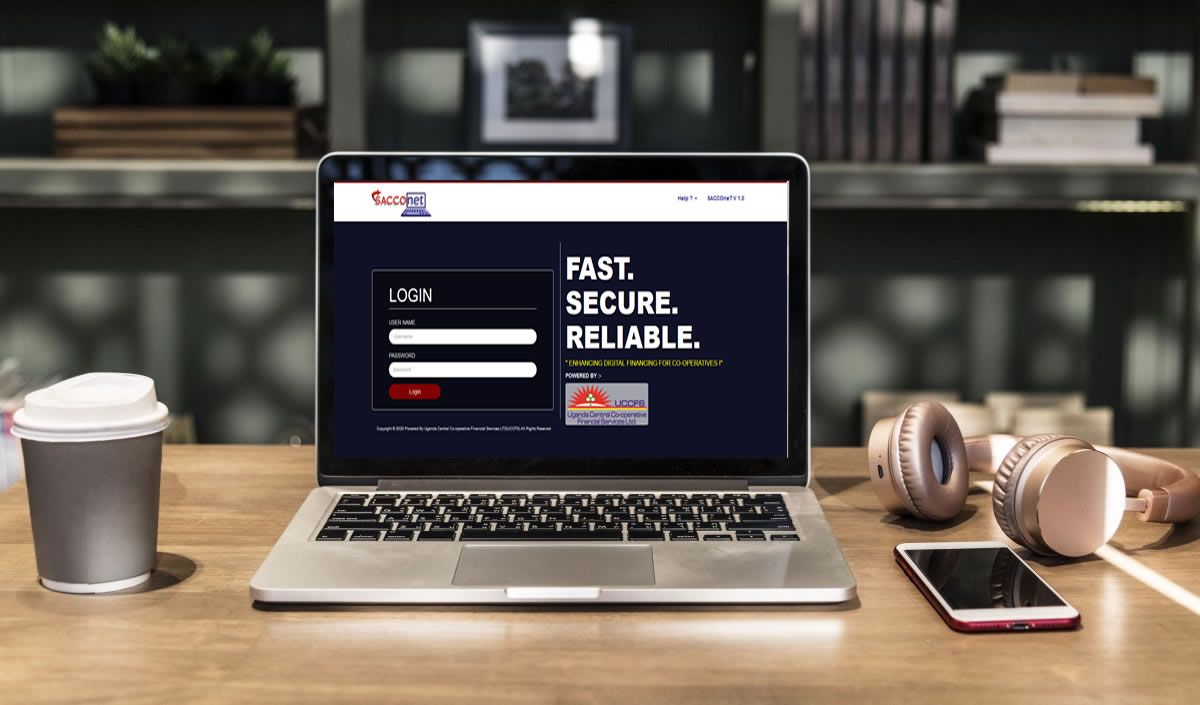

Developed & Powered by

Sakkonet Technologies Ltd is a subsidiary company of Uganda Central Cooperative Financial Services Ltd (UCCFS) established to provide Digital Financial Services to the cooperative movement in Uganda on behalf of UCCFS. Sakkonet technologies Ltd specializes in the development, marketing and selling of SACCONet core banking solution for micro finance institutions in Uganda.

Uganda Central Cooperative Financial Services Ltd (UCCFS) specializes in the provision of co-operative financial services (Financial intermediation) to all types of Co-operatives (Apexes, Unions, SACCOs, RPOs, ACEs, and other primary Cooperatives) in Uganda.

Our Vision

“To be Africa’s leading provider of innovative, secure, and inclusive FinTech solutions that empower community financial institutions and transform lives.”

Our Mission

“To design, develop, and deliver scalable digital financial solutions that enable SACCOs and microfinance institutions to operate efficiently, securely, and transparently while promoting financial inclusion.”

SACCONET Target Users

SACCONET is a Cloud-based Banking Solution for:

Savings and Credit Cooperatives (SACCOs)

We help SACCOs with the most reliable and cheapest way to grow savings, efficient tracking of loans, shares, and basic accounting system support.

Microfinance Institutions

SACCONET provides a multi-userMIS platform for micro-finance combining basic client data with Shares, avings and Loans transactions with every entry automatically updated in the General Ledger

Village Savings and Loan Associations (VSLA)

We help VSLA to automate their activities in order for them to grow savings, efficient tracking of loans and proper records keeping