The Uganda Cooperative Savings and Credit Union (UCCFS) and Stanbic Bank Uganda have continued to strengthen their partnership, working hand in hand to improve financial access and drive digital integration across the cooperative sector. This collaboration reflects a shared commitment to ensuring that Savings and Credit Cooperative Societies (SACCOS) are equipped with the right tools, systems, and support to meet the evolving needs of their members.

Through joint initiatives, UCCFS and Stanbic Bank are championing affordable and accessible financial services tailored for cooperative institutions. This includes developing products that enhance liquidity for SACCOS, expanding access to credit, and supporting financial inclusion for underserved communities. By combining UCCFS’s expertise in the cooperative movement with Stanbic Bank’s financial capacity and infrastructure, the partnership is opening new pathways for sustainable growth.

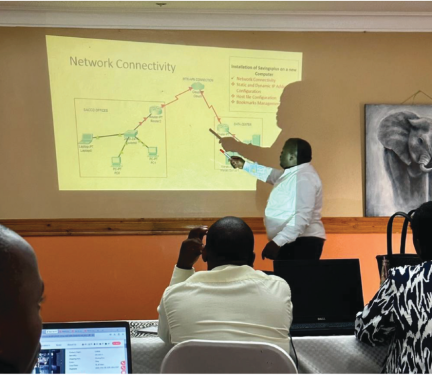

A key area of focus has been digital integration. Many SACCOS have historically relied on manual processes, which limited efficiency and made it difficult to scale services. With Stanbic Bank and UCCFS providing technical support, SACCOS are now adopting digital channels that streamline operations, enable mobile and online transactions, and improve transparency. This shift not only modernizes financial service delivery but also strengthens trust between SACCOS and their members.

The collaboration also emphasizes cooperative financial solutions that are tailored to the realities of local communities. By listening to the needs of SACCO leaders and members, UCCFS and Stanbic Bank are co-creating solutions that empower cooperatives to grow stronger, manage risk better, and serve as engines of financial inclusion in Uganda.

Looking ahead, both institutions are committed to deepening their engagement, with innovation at the heart of their strategy. The groundwork being laid today in financial access, digital transformation, and cooperative-centered products will serve as a foundation for future solutions that ensure SACCOS remain resilient, sustainable, and responsive to their members’ needs.